The number of consumers browsing and buying online will reach 270 million by 2020, driven largely by activity on mobile devices, according to Forrester.

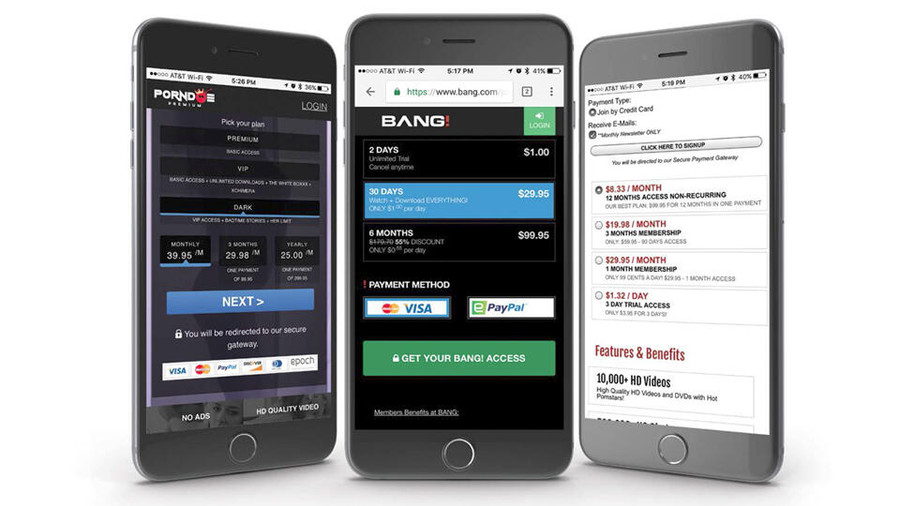

Business is booming and the fact that most purchases are made on a mobile device means ensuring your website is mobile-friendly and provides a problem-free and enjoyable experiences for your customers on mobile devices should be near the top of your list of priorities.

There aren’t many things worse than a low authorization rate because your merchant processor has high scrub rates and potential sales are lost.

An irritating experience that often drives me away from a site when I’m on my mobile is if I have to swipe left and right, in addition to up and down, in order to browse products and complete the checkout process. A close second is if the site takes forever to render. If it takes too long, I’ll go to another site.

Your website, content, product and checkout process should be beautiful, seamless and fast on both desktop and mobile applications in order to yield the highest possible number of sales. I’ve done more shopping on my phone and tablet than I have from my desk in the last year than I can count.

I shop while waiting for my daughter to get out of school, at a restaurant waiting for my food, and sometimes even while I’m standing in a store and decide to check if the price of something is lower online. Shopping online and from a mobile device is where we’re seeing the most growth.

In addition to aesthetics and functionality, having a strong merchant processing solution is just as important! There aren’t many things worse than a low authorization rate because your merchant processor has high scrub rates and potential sales are lost.

Understandably, the high scrub rates are due to a number of factors, including where the transaction is originating, where the bank of the card number is located, and other strict transaction requirements, among many other factors, which is why it’s important to do what you can, as a merchant, to protect your business and your transactions. Requiring full AVS (not just the ZIP Code, but the numbers of the billing address, too) and positive CVV responses are also very important as antifraud features.

Collecting this information and only allowing the transaction to be completed with positive responses to both AVS and CVV inquiries demonstrates that, in all likelihood, the person conducting the transaction is authorized to use the credit card being used for the sale.

This will result in fewer chargebacks, especially under the fraud reason codes. Another advantage to consider is broadening the scope of your payments. Cards issued by European banks show a higher authorization rate at merchant processors based in the E.U. and conversely, cards issued by American banks show higher authorization rates at merchant processors based in the U.S.

Once your website experience is conducive to a pleasant mobile experience and you’ve partnered with a strong and reliable merchant processor, ensuring your customer service is customer-focused will also go a long way in reducing your chargebacks.

Your customer service team should be easy to reach and responsive. I understand not everyone has the staff to dedicate to a phone number and many customers prefer to use email to communicate, but being responsive to email and making the customer feel heard and understood also helps tremendously with the mitigation of chargebacks. Remember: a refund is always cheaper than a chargeback.

Lastly, using chargeback monitoring and prevention tools are the last line of defense. By this point, you should have a mobile-friendly website, a strong and reliable merchant processor and a friendly, helpful customer service team.

The last piece of the puzzle is chargeback prevention and response services offered by only the best merchant processors in our industry. These tools will help you identify potential chargebacks before they happen and help respond to chargebacks that do happen and at least recover the cost of your goods or services and put more money back in your wallet!

With all that being said, maybe your website is already optimized for mobile visitors and your customer service team is second to none — are you happy with your merchant account? Do you need room to grow? Would you like to see higher authorization rates? Are you paying too much? There are many questions that should be asked of the people you pay to provide a service to you — not just your merchant account provider, of course.

There have been too many times for me to count where I’ve received an urgent phone call or email from a merchant who was just terminated from merchant processing for one reason or another (not always a match) and he didn’t have a backup processor in place. I’m good, but I’m not a miracle worker.

I do what I can to get a new merchant account established as quickly as possible, but the stress of losing potential sales because they don’t have a method of accepting credit cards isn’t something any merchant should ever experience. It’s good to have a backup!

Even if you don’t think you need a backup, having more than one merchant account can also help you accommodate growth. Nothing can be more maddening as a business owner than being told you can’t process more than you’re approved monthly volume without jumping through hoops and waiting to hear back from some pencil pusher who’s only concerned with chargeback and return ratios.

Give it some consideration. Any reputable and decent merchant processor won’t charge you for a cost analysis to show you what you’re really paying, and what you could be paying and any respectable merchant processor won’t hound you to sign up until you succumb to their relentless emails and phone calls.

Jonathan Corona has more than a decade of experience in the electronic payments processing industry. As Mobius Payments Inc.’s vice president of compliance, Corona is primarily responsible for day-to-day operations as well as reviewing and advising merchants on a multitude of compliance standards set forth by the card associations. Mobius Payments specializes in high-risk merchant accounts in the U.S., E.U. and Asia.